How to Use Marketing Budget KPIs for Decision-Making

October 1, 2020

By Paul Schmidt

One of the most underrated skill sets of a marketing leader is the ability to guide decision-making based on budgetary analysis. The most skilled marketers aren't just the ones who can identify the best channels for growing customers; they are also the ones who can identify the best channels to avoid.

Key KPIs to Track in Your Marketing Budget

By channel or tactic, you should be tracking the following key performance indicators (KPIs):

- Budget: How much capital you are allocating to a specific channel or tactic

- Amount spent: How much capital has been expended during a given time period

- Amount left: The amount of capital you have left to expend during that same time period

- Cumulative budget: The total budget summed up across all marketing channels

- Cumulative spend: The total budget expended across all marketing channels

To make this simple, we developed this easy-to-use template to help you track your expenses each month.

5 Way to Use Marketing Budget KPIs to Guide Decision-Making

Now that you know which KPIs to track monthly, here are five areas where you can use those KPIs to help guide decision making.

1. Marketing efficiency

This is the one KPI you should have taped to your monitor and know before researching any marketing opportunity. As a marketer, we only have so many dollars to spend and hours in a day. How much are you spending for each new lead, opportunity, and customer?

Here are the formulas you should be using to measure your efficiency by channel:

- Cost per lead (CPL) = Marketing spend by channel ÷ New leads generated by channel

- Cost per opportunity = Marketing spend by channel ÷ New opportunities generated by channel.

- Customer acquisition cost (CAC) = Marketing spend by channel ÷ New customers generated by channel

You should look at each channel to understand how much you are paying for leads, opportunities, and customers compared to another source of leads. As new marketing or advertising opportunities come along, you should use these KPIs as the litmus test for further investment.

Attribution is the most common question that comes up when measuring marketing efficiency. Should you give credit to the channel that a lead first came in from, or should the credit go to the channel they came in from prior to converting? There isn't a right answer to this question, and each analytics platform handles it differently. Depending on the attribution tool you are using, choosing either a linear or U-shaped attribution model allows you to give credit to multiple touchpoints throughout your Buyers Journey.

2. Budget pacing

Each week you should know two things: What percentage through the year are you, and how much of your quarterly or yearly budget have you spent? A common mistake marketers make is over- or under-pacing their budget. Unless you have real-time access to invoices from each channel, you can’t see why mistakes occur.

Take inventory of every technology, vendor, and advertising or media cost that count against your budget. At the beginning of your budgetary year, plan out what percentage of your budget you should work through during each month of the year. Marketers should account for swings in seasonality, one-time large costs (i.e., trade shows), competitive pressures, and staffing considerations as they go through budgetary planning.

Don't get 75 percent of the way through the year and have spent your entire budget. Similarly, don't get through 99 percent of your year and leave 25 percent of your budget on the table.

3. Marketing and finance alignment

Just like with budget pacing, marketers need to be accountable for every invoice and collaborate with finance to ensure their departmental goals are aligned.

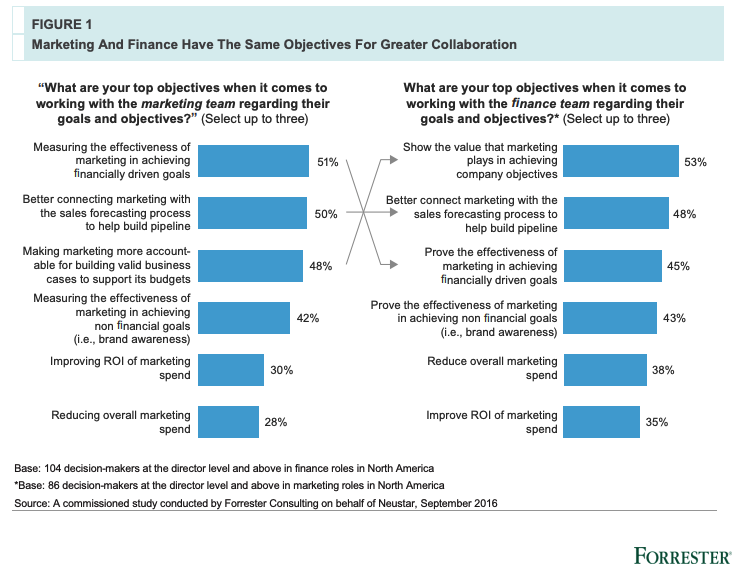

This report shows us marketing and finance’s overarching objectives when working across departments:

Forrester's report discusses these three activities to get finance and marketing to work closer together:

- Making more joint decisions

- Viewing marketing as a growth center instead of a cost center

- Improving understanding of each department's organizations goals

Coming to the table with a clear budget and spend amounts will help you collaborate better with your finance department, and make it easier for you to build business cases for future marketing investments.

4. Industry benchmark comparisons

Take every industry benchmark (especially here or here) with a grain of salt. Depending on whether you’re a high-growth company or a company in a mature vertical, this will often dictate your marketing budgets.

Your corporate goals, which should align with your marketing goals, will dictate the amount of budget you need to succeed.

5. Controlling technology and vendor costs

How much are you spending on software, agencies, freelancers, writers, designers, or developers? These should be line items in your budget, so that you can predictably measure how on or off track you are, when it comes to hitting your budgetary goals each year.

Budgeting isn't the most enjoyable job for a marketer, but not having a clear view of your budgetary KPIs across tactics, channels, and vendors will put you and your team's job and goals at risk.

About the author

Paul Schmidt is a director of services strategy at SmartBug Media. He previously worked at HubSpot, helping develop inbound strategies for over 200 clients. His past clients include: Travelers Insurance, Unilever, and the SABIAN Cymbal Company. Paul studied percussion in Las Vegas and got his MBA in marketing in Boston Read more articles by Paul Schmidt.